Lifecycle investing

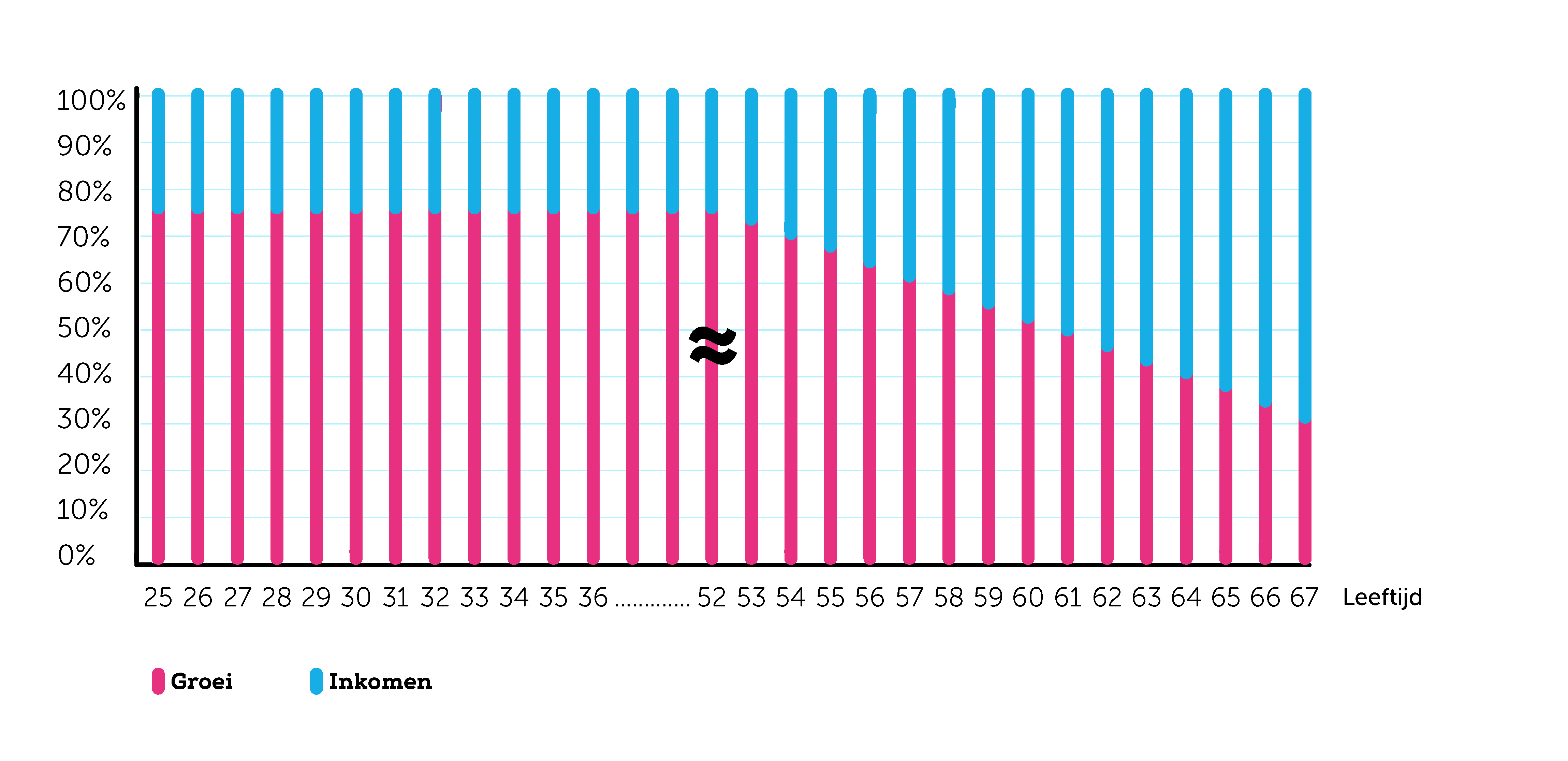

At Bright, we practice lifecycle investing. This means that the level of risk is adjusted to the participant’s age. The closer to the end date, the less risky the investments become.

We invest in the Bright LifeCycle Fund, which consists of two subfunds: Growth and Income. Growth mainly consists of stocks, while Income mainly consists of green bonds.

Our members’ accounts are automatically placed in the Standard Lifecycle. During the accumulation phase, this lifecycle has an allocation of 75% Growth and 25% Income. In our view, the Standard Lifecycle offers the best risk-return balance to achieve our target return of 6% for as many members as possible.

Fifteen years before the account’s end date – in the case of a pension account, the retirement age – we gradually reduce risk in small monthly steps. You can see that here:

Choices for you

Choices for you

In addition to the Standard Lifecycle, we offer other options. For each Bright account you use, you can make your own choice. You have three options:

You want to continue following the Standard Lifecycle

In this case, you leave everything as it is. You don’t need to do anything.

You want to follow a different lifecycle

Do you want to take on a bit more or less risk while keeping the automatic risk reduction? In your Bright environment, you can also choose from four other lifecycles: two that are slightly more and two that are slightly less aggressive than the Standard Lifecycle.

- Lifecycle Stocks+ and Lifecycle Stocks++

Contain more stocks and are more aggressive than the Standard Lifecycle. - Lifecycle Bonds+ and Lifecycle Bonds++

Contain fewer stocks and are less aggressive than the Standard Lifecycle.

More about the five lifecycles can be found further down this page.

You want to invest outside of a lifecycle

If you don’t want your investment mix to follow a lifecycle, you can also choose your own allocation between the Growth and Income funds via your Bright environment. This could be a consideration for the investment account, where you may be investing for different goals than with your pension account.

In this case, your risk will no longer be automatically reduced. If you later decide you do want this, you can switch to a lifecycle at any time.

Know what you’re choosing

We emphasize the importance of making these choices carefully and with proper knowledge. That’s why you will first need to complete a knowledge and experience test before you can deviate from the Standard Lifecycle.

Changing your investment mix doesn’t cost you any money. However, frequently switching strategies is not advisable. Successful investing is about patience and a long-term vision. Read more about this in our investment strategy (dutch).

The five lifecycles

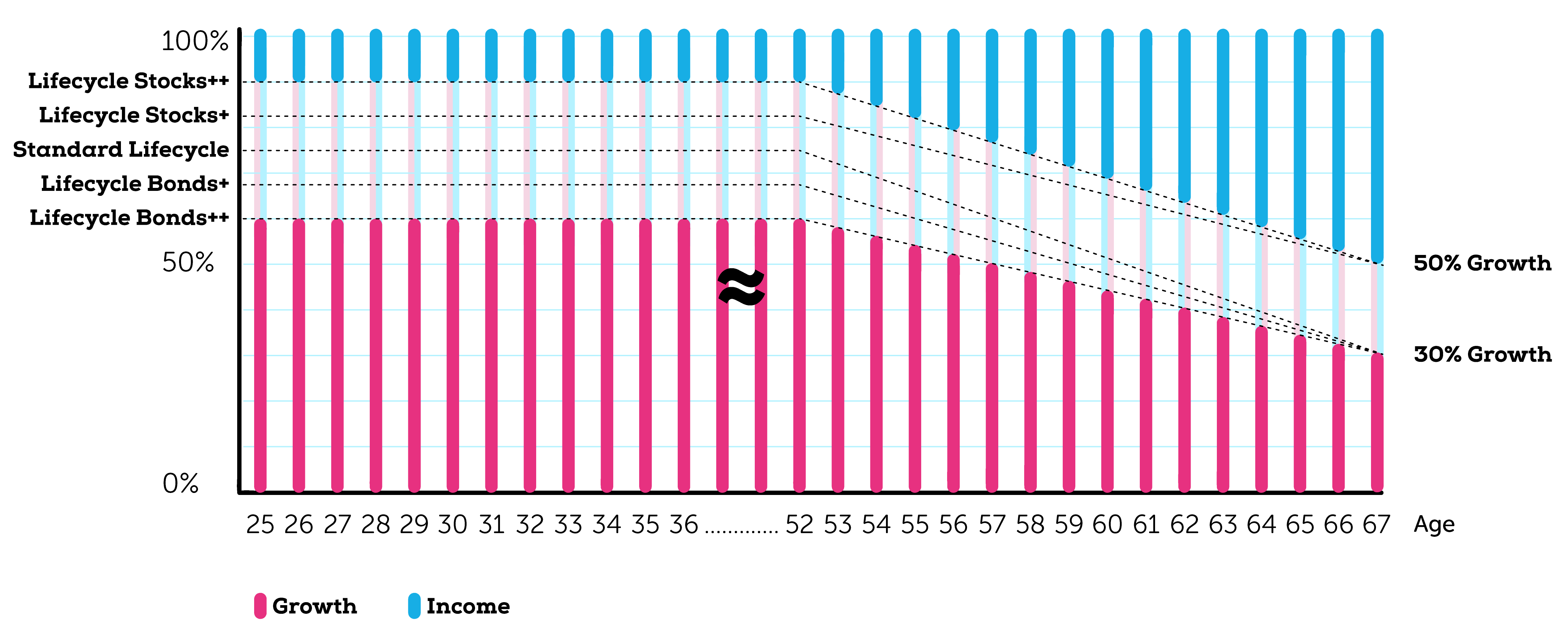

Our five lifecycles each have a different allocation between the Growth and Income funds, and therefore a different balance between stocks and bonds. This allocation determines the risk-return ratio. The distribution in the accumulation phase differs from that in the de-risking phase.

Allocation in the accumulation phase

- Lifecycle Stocks++

Contains 90% Growth and 10% Income - Lifecycle Stocks+

Contains 82.5% Growth and 17.5% Income - Standard Lifecycle

Contains 75% Growth and 25% Income - Lifecycle Bonds+

Contains 67.5% Growth and 32.5% Income - Lifecycle Bonds++

Contains 60% Growth and 40% Income

Transitioning to your payout

The allocation between the Growth and Income funds is gradually reduced over a 15-year period leading up to the end date. In the case of a pension account, this means the start of retirement, or the beginning of the payout phase.

The Standard Lifecycle, Lifecycle Bonds+, and Lifecycle Bonds++ reduce risk to 30% Growth and 70% Income. The idea behind this choice is to aim for a fixed pension payout at a fixed interest rate.

Lifecycle Stocks+ and Lifecycle Stocks++ reduce risk to 50% Growth and 50% Income. This approach is intended for a variable payout, where investments continue during the payout phase.

At Bright, we do not yet offer a payout product, but we plan to introduce one in the near future.

The graph below illustrates the five lifecycles, showing the two different de-risking levels.

Risks and returns

The balance between Stocks and bonds determines the risk-return ratio. More Stocks generally mean higher risk but also a greater chance of high returns. More bonds typically mean lower risk and a lower chance of high returns.

All five lifecycles have a risk indicator of 4, representing medium risk on a scale from 1 to 7. Investing involves risks, and we cannot guarantee future returns—no matter how Bright we are.

Our goal is to create a Bright future for as many members as possible. For all lifecycles, we aim for a target return of 4% above inflation.

More information about the expected returns per lifecycle can be found in the Essential Information Documents (EIDs), available in the document center (dutch).